Insurance Business Process Outsourcing

Insurance companies often opt for Business Process Outsourcing (Insurance BPO) services over maintaining in-house talent due to several compelling reasons. Firstly, outsourcing allows companies to access a broader talent pool with specialized skills and expertise tailored to the insurance industry. BPO providers, like Connect2BPO, offer seasoned professionals who understand the intricacies of insurance processes, enabling companies to benefit from their knowledge without the overhead of hiring and training in-house staff. Additionally, outsourcing offers flexibility and scalability, allowing companies to scale operations up or down as needed without the constraints of maintaining a fixed workforce.

Connect2BPO offers comprehensive Insurance BPO services to streamline operations and enhance business performance. Leveraging our expertise in BPO established in 2016, strategically located in Barranquilla, Colombia, we specialize in Lead Generation and Sales Campaigns with proven effectiveness.

At Connect2BPO, our foremost priority is customer satisfaction. Through our tailored services and proactive assistance, we guarantee that your customers receive the utmost attention and care, nurturing enduring loyalty and retention.

Which insurance processes can you outsource?

Looking to optimize your insurance operations? Discover the multitude of insurance processes that you can entrust to Connect2BPO. With our proven delivery and engagement commitment, our insurance BPO services are best suited to be your strategic partner in your journey to be a leading insurance player in the industry. By outsourcing these tasks, you can focus on core business activities while we handle the intricacies of:

Data processing:

Streamline your data processing tasks for improved accuracy and efficiency.

Data mining:

Harness the power of data analytics to gain valuable insights and drive strategic decision-making.

IT services:

Access cutting-edge IT solutions to optimize your technological infrastructure and enhance operational capabilities.

Call center:

Enhance customer service and support with our dedicated call center solutions.

Underwriting:

Improve underwriting processes for faster turnaround times and reduced risk.

Finance and accounting:

Streamline financial operations and ensure compliance with industry regulations.

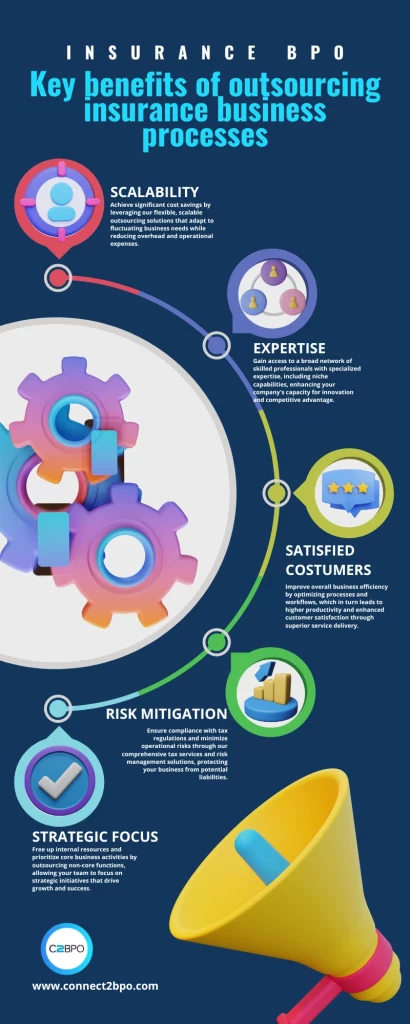

Key benefits of outsourcing insurance business processes

Outsourcing insurance business processes to a reputable BPO provider like Connect2BPO offers many benefits that can significantly impact a company’s bottom line and operational effectiveness. By partnering with us, insurance companies can unlock opportunities for growth and efficiency.

Insurance outsourcing companies provide a cost-effective solution for insurance companies, reducing overhead expenses associated with maintaining in-house departments. Connect2BPO offers access to a larger talent pool of skilled professionals with specialized expertise in insurance processes, ensuring high-quality service delivery and improved operational efficiency. Furthermore, outsourcing provides flexibility and scalability, allowing companies to adapt quickly to changing market demands without the constraints of fixed personnel.

Through Connect2BPO’s outsourcing solutions, insurance companies can streamline operations, reduce turnaround times, and enhance customer satisfaction. Our risk management and compliance expertise ensures regulatory adherence, mitigating potential risks and uncertainties. Ultimately, outsourcing insurance business processes enables companies to focus on core business activities while leveraging Connect2BPO’s industry knowledge and resources to drive success.

Cost savings:

Reduce overhead costs and increase profitability with our cost-effective outsourcing solutions.

Larger talent pool:

Access a diverse talent pool of experienced professionals with specialized skills and expertise.

Flexibility and scalability:

Scale your operations up or down quickly and easily to adapt to changing business needs.

Tax Services:

Ensure compliance with tax regulations and optimize your tax strategy with our expert tax services.

Increased efficiency:

Streamline processes and workflows to improve operational efficiency and productivity.

Access to expertise/Niche specialization:

Tap into our domain expertise and niche specialization to drive innovation and competitive advantage.

Improved customer satisfaction:

Enhance customer satisfaction with superior service delivery and support.

Risk management:

Mitigate risks and ensure regulatory compliance with our robust risk management solutions.

Focus on core business activities:

Free up valuable time and resources to focus on core business activities and strategic initiatives.

The real decision! Choosing an insurance BPO provider

When choosing an insurance BPO provider, it’s essential to evaluate their expertise in the insurance industry and their ability to handle specific regulatory requirements like HIPAA or SOX. A provider with extensive experience in handling different types of insurance (such as life, health, or property) will be better equipped to manage the unique processes and challenges within your business. Additionally, their ability to navigate the complexities of insurance-related compliance ensures your business stays protected from regulatory risks.

Technology and scalability are also crucial factors, make sure that the right Insurance Business Outsourcing provider should leverage advanced technologies like AI, automation, and machine learning to enhance operational efficiency, and other BPO trends. At the same time, they must have robust security measures to protect sensitive customer data. Scalability and flexibility are important as well, especially if your company experiences fluctuating demands. A provider that can adjust to changing business needs, whether through increasing capacity during peak times or supporting multiple geographic regions, is ideal.

Finally, cost structure and value should be carefully examined. Transparent pricing models that align with your budget are essential, but so is the overall value the provider brings. Look for additional services, such as process optimization or customer analytics, which could provide a competitive edge. Checking the provider’s reputation, client feedback, and cultural fit will help ensure they are reliable and can form a productive, long-term partnership with your company.

How Connect2BPO helps the Insurance Industry

Connect2BPO is committed to revolutionizing the insurance industry through our tailored outsourcing solutions and unparalleled expertise. Discover how our strategic approach and dedication to excellence can help your organization achieve:

Operational Excellence:

By leveraging our extensive experience and industry knowledge, we optimize your processes to drive operational excellence and maximize efficiency.

Growth Acceleration:

Our innovative solutions and scalable resources empower you to seize new opportunities, expand your market presence, and accelerate growth.

Customer-Centric Approach:

At Connect2BPO, we prioritize customer satisfaction above all else. Our personalized services and proactive support ensure that your customers receive the attention and care they deserve, fostering long-term loyalty and retention.

Risk Mitigation:

We understand the complexities and challenges inherent in the insurance industry. We offer robust risk management strategies and compliance solutions to safeguard your business against potential threats and uncertainties.

Optimize Your Business Growth by Hiring a Team of Experienced Professionals – Connect2BPO

Unlock your full potential and achieve sustainable growth by partnering with the insurance BPO services insurance outsourcing. Our team of experienced professionals is ready to support your business goals and drive success. Contact us today to learn more about our Insurance Business Process Outsourcing (BPO) services and how we can help you thrive in a competitive marketplace.