Michael, the CFO of a growing manufacturing company, sat in the quarterly board meeting confidently presenting financials: “Revenue is up 25%, we’ve hired 30 new people, and we opened two new facilities.” The board chair asked a pointed question: “That’s impressive growth, but are we actually profitable? What’s our cash position, and can we sustain this expansion?”

Michael realized he had been reporting growth metrics without tracking financial health indicators. After implementing proper financial KPI tracking, the reality was sobering: despite revenue growth, profit margins had dropped from 18% to 9%, cash flow was negative for three consecutive months, and their debt-to-equity ratio had doubled. Working capital was tied up in inventory, and customer payment terms were stretching to 75 days. However, this clarity enabled decisive action. Within nine months of focusing on the right financial KPI examples, they improved margins to 16%, achieved positive cash flow, reduced days sales outstanding to 45 days, and strengthened their balance sheet significantly.

This comprehensive guide explores what is a financial KPI, provides essential frameworks for financial analyst KPI tracking, and shows you how to build a financial KPI dashboard that drives sound financial decision-making.

What Is a Financial KPI?

What is a financial KPI exactly? A financial Key Performance Indicator is a quantifiable measurement that evaluates the financial health and performance of an organization. These metrics go beyond basic accounting numbers to provide actionable insights about profitability, liquidity, efficiency, and long-term sustainability.

Financial KPIs serve critical functions:

- Assess overall financial health and stability

- Enable early warning of potential financial issues

- Guide strategic investment and resource allocation decisions

- Demonstrate financial performance to stakeholders and investors

- Support compliance and governance requirements

Core Financial KPI Categories

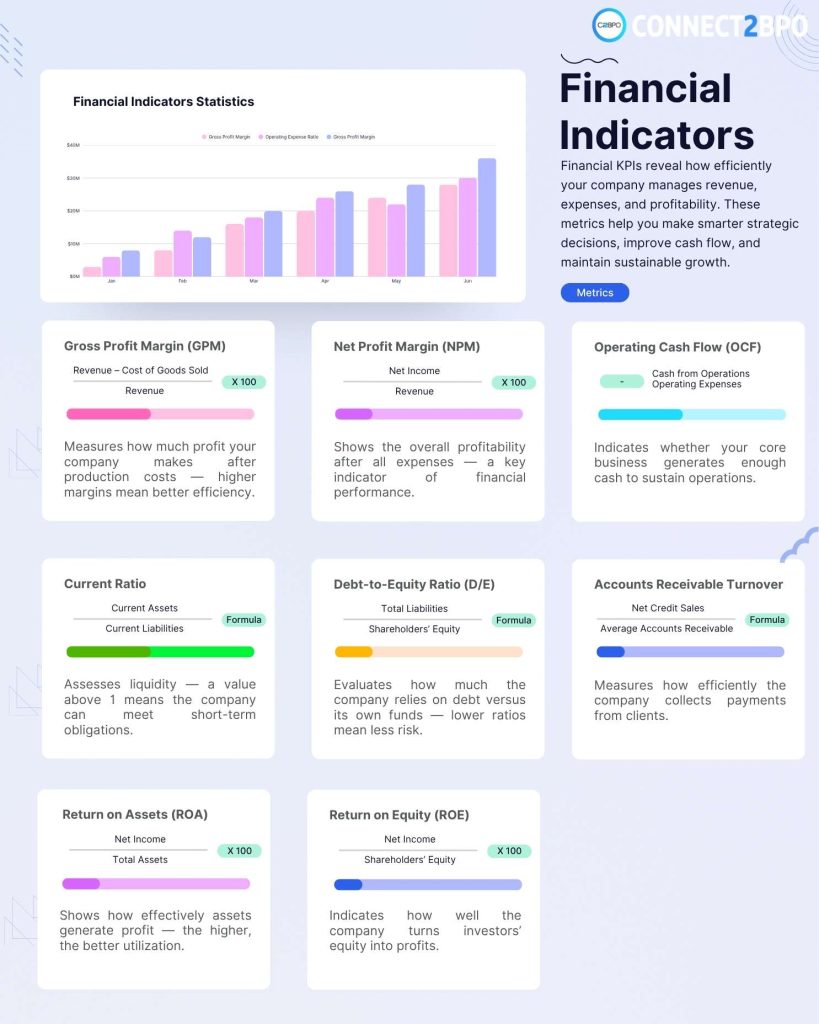

Profitability Metrics

Gross Profit Margin The percentage of revenue remaining after direct costs of production.

📊 Formula: ((Revenue – Cost of Goods Sold) ÷ Revenue) × 100

🎯 Industry Variance: Software companies often achieve 70-90%, while retailers typically see 20-40%

Net Profit Margin The percentage of revenue that becomes actual profit after all expenses.

📊 Formula: (Net Income ÷ Revenue) × 100

💡 Strategic Insight: Declining net margins despite revenue growth signals cost control issues or pricing pressure

Return on Assets (ROA) Measures how efficiently a company uses its assets to generate profit.

📊 Formula: (Net Income ÷ Total Assets) × 100

🎯 Benchmark: 5% is average; 20%+ indicates exceptional asset efficiency

Return on Equity (ROE) Shows the return generated on shareholder investments.

📊 Formula: (Net Income ÷ Shareholders’ Equity) × 100

📈 Interpretation: 15-20% is considered good for most industries

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) Measures operational profitability independent of financing and accounting decisions.

📊 Formula: Net Income + Interest + Taxes + Depreciation + Amortization

💡 Use Case: Ideal for comparing companies with different capital structures

Liquidity Metrics

Current Ratio Measures ability to pay short-term obligations with current assets.

📊 Formula: Current Assets ÷ Current Liabilities

🎯 Target: 1.5 to 3.0 (below 1.0 indicates potential liquidity problems)

Quick Ratio (Acid Test) More conservative liquidity measure that excludes inventory.

📊 Formula: (Current Assets – Inventory) ÷ Current Liabilities

⚠️ Warning Sign: Quick ratio below 1.0 suggests difficulty meeting immediate obligations

Cash Ratio The most conservative liquidity metric, measuring only cash and equivalents.

📊 Formula: (Cash + Cash Equivalents) ÷ Current Liabilities

💰 Interpretation: Higher ratios indicate stronger ability to handle unexpected expenses

Operating Cash Flow Cash generated from core business operations, excluding financing and investing activities.

💡 Critical Insight: A company can be profitable on paper but fail due to negative cash flow

Efficiency Metrics

Days Sales Outstanding (DSO) Average number of days to collect payment after a sale.

📊 Formula: (Accounts Receivable ÷ Total Credit Sales) × Number of Days

🎯 Target: 30-45 days for most B2B businesses; lower is better

Days Payable Outstanding (DPO) Average number of days a company takes to pay suppliers.

📊 Formula: (Accounts Payable ÷ Cost of Goods Sold) × Number of Days

⚖️ Balance: Higher DPO preserves cash but may strain supplier relationships

Inventory Turnover How many times inventory is sold and replaced during a period.

📊 Formula: Cost of Goods Sold ÷ Average Inventory

📊 Industry Variance: Fast-moving consumer goods: 10-20×; Luxury goods: 2-4×

Asset Turnover Ratio Measures revenue generated per dollar of assets.

📊 Formula: Revenue ÷ Total Assets

💡 Insight: Higher ratios indicate efficient asset utilization

Working Capital Ratio Measures operational liquidity and short-term financial health.

📊 Formula: Current Assets ÷ Current Liabilities

🎯 Healthy Range: 1.2 to 2.0

Leverage and Solvency Metrics

Debt-to-Equity Ratio Compares total debt to shareholder equity, measuring financial leverage.

📊 Formula: Total Debt ÷ Shareholders’ Equity

🎯 Interpretation: Below 1.0 is conservative; above 2.0 indicates high leverage

Interest Coverage Ratio Measures ability to pay interest expenses from operating income.

📊 Formula: EBIT ÷ Interest Expense

⚠️ Warning Level: Below 2.0 suggests difficulty servicing debt

Debt Service Coverage Ratio Evaluates ability to service all debt obligations including principal.

📊 Formula: Net Operating Income ÷ Total Debt Service

🎯 Lender Requirement: Most lenders require 1.25 or higher

Financial KPI Examples by Role

Financial Analyst KPI

- Financial analyst KPI metrics focus on accuracy, insight generation, and supporting strategic decisions. Key performance indicators for financial analysts include:

- Forecast Accuracy: Variance between financial projections and actual results, typically measured monthly and quarterly. Analysts aim for forecast accuracy within 5% of actuals.

- Report Delivery Timeliness: Percentage of financial reports and analyses delivered by deadline. Top-performing analysts maintain 95%+ on-time delivery while ensuring data accuracy.

- Variance Analysis Quality: Ability to identify and explain material variances in financial performance, providing actionable insights for management decision-making.

- Model Reliability: Accuracy and usefulness of financial models created for valuation, budgeting, and scenario planning. Models should require minimal adjustments and provide consistent, reliable outputs.

- Stakeholder Satisfaction: Internal customer feedback on the quality, clarity, and usefulness of financial analysis and recommendations provided.

Financial Controller KPI Examples

- Financial controller KPI examples emphasize accuracy, compliance, and timely financial reporting. Controllers are responsible for the integrity of financial data and systems:

- Month-End Close Cycle Time: Number of business days required to complete monthly financial close. Best-in-class organizations achieve close within 3-5 business days.

- Financial Statement Accuracy: Number of material adjustments or restatements required post-close. Target is zero material adjustments after initial reporting.

- Compliance Rate: Percentage of regulatory filings and reports submitted on time without deficiencies. Controllers must maintain 100% compliance to avoid penalties and maintain stakeholder trust.

- Internal Control Effectiveness: Number of control deficiencies identified during internal or external audits. Strong financial controls show zero material weaknesses and minimal significant deficiencies.

- Accounts Reconciliation Completion: Percentage of account reconciliations completed within established timelines. Best practice requires 100% completion before month-end close.

- Audit Findings: Number and severity of findings from internal and external audits. Effective controllers minimize audit adjustments and control deficiencies year over year.

KPI Financiers and Investment Metrics

Kpi financiers—the metrics that investors, lenders, and financial institutions focus on when evaluating companies—often differ from internal operational KPIs. These external stakeholders prioritize indicators of financial stability, growth potential, and return on investment:

Revenue Growth Rate: Year-over-year and quarter-over-quarter revenue growth percentages. Investors seek consistent growth rates that demonstrate market traction and scalability.

Customer Acquisition Cost (CAC) Payback Period: For subscription businesses, how quickly customer revenue recovers acquisition costs. Investors prefer payback periods under 12 months.

Burn Rate and Runway: For startups and growth companies, monthly cash consumption and months of operation remaining at current spend levels. Critical for fundraising timing decisions.

Return on Invested Capital (ROIC): Measures returns generated on all capital invested in the business, both debt and equity. Strong companies achieve ROIC above their weighted average cost of capital.

Free Cash Flow: Cash generated after capital expenditures, available for distribution to investors or reinvestment. Positive and growing free cash flow is highly valued by investors.

Customer Lifetime Value to CAC Ratio: For subscription and recurring revenue businesses, ratio of customer lifetime value to acquisition cost. Healthy businesses achieve 3:1 or higher.

Building Your Financial KPI Dashboard

A well-designed financial KPI dashboard provides at-a-glance visibility into financial health while enabling deeper analysis when needed. Whether you’re building a financial KPI dashboard excel solution or using specialized software, certain principles ensure effectiveness.

Dashboard Design Principles

Executive Financial Dashboard (5-8 metrics): Focus on high-level financial health indicators that drive strategic decisions. Include revenue, profitability margins, cash position, key efficiency ratios, and debt levels. Update monthly with trend indicators showing direction of change.

Controller/Finance Team Dashboard (15-20 metrics): Provide detailed operational financial metrics for managing day-to-day financial operations. Include detailed cash flow components, accounts receivable aging, accounts payable status, budget variance analysis, and working capital details.

Department Manager Dashboard (8-12 metrics): Show department-specific budget performance, cost trends, and efficiency metrics. Enable managers to understand their financial impact and make informed operational decisions.

Essential Dashboard Components

Trend Visualization: Don’t show only current period numbers—display 6-12 months of historical trends to identify patterns and momentum. Use sparklines in Excel or trend charts in BI tools to show direction at a glance.

Variance Analysis: Include comparisons against budgets, forecasts, and prior periods. Color-code variances (green for favorable, red for unfavorable) to enable quick identification of areas requiring attention.

Key Ratios and Benchmarks: Display critical financial ratios alongside industry benchmarks to provide context. A 10% net margin means different things in software versus retail.

Cash Flow Focus: Given that cash flow issues cause most business failures, prominent cash position and cash flow trend displays are essential. Include current cash, projected cash in 30/60/90 days, and cash conversion cycle metrics.

Financial KPI Dashboard Excel Implementation

Many organizations start with financial KPI dashboard excel solutions before graduating to specialized software. Excel remains powerful for financial dashboards when structured properly:

Data Source Structure: Create separate worksheets for raw data inputs, calculations, and dashboard display. Link cells rather than duplicating data to maintain consistency.

Automated Data Refresh: Use Excel’s data connection features to automatically refresh from accounting systems, reducing manual data entry and errors.

Visual Design: Leverage conditional formatting for color-coding, sparklines for trends, and Excel charts for visualizations. Keep designs clean and uncluttered.

Version Control: Implement clear file naming conventions and maintain version history. Consider using SharePoint or OneDrive for collaborative access and automated backups.

Calculation Accuracy: Use named ranges and cell references rather than hard-coded values. Build in data validation and error checking to prevent calculation errors.

Industry-Specific Financial KPI Examples

SaaS and Subscription Business

- Monthly Recurring Revenue (MRR): Predictable revenue from subscriptions, the foundation metric for subscription businesses.

- Annual Recurring Revenue (ARR): MRR multiplied by 12, used for strategic planning and valuation.

- Customer Churn Rate: Percentage of customers canceling subscriptions monthly or annually.

- Net Revenue Retention: Revenue retained from existing customers including expansion, upgrades, downgrades, and churn. Best-in-class SaaS companies achieve 120%+ NRR.

Manufacturing

- Manufacturing Cost per Unit: Total production costs divided by units produced, crucial for pricing and margin management.

- Inventory Carrying Cost: Total cost of holding inventory including storage, insurance, obsolescence, and opportunity cost.

- Production Efficiency Variance: Actual production costs compared to standard costs, revealing operational efficiency.

Retail

- Same-Store Sales Growth: Revenue growth from locations open at least one year, isolating organic growth from expansion.

- Inventory Shrinkage Rate: Percentage of inventory lost to theft, damage, or administrative errors.

- Sales per Square Foot: Revenue generated per square foot of retail space, measuring space utilization efficiency.

Professional Services

- Utilization Rate: Percentage of billable hours actually billed to clients versus total available hours.

- Realization Rate: Percentage of standard billing rates actually collected after discounts and write-offs.

- Revenue per Employee: Total revenue divided by full-time equivalent employees, measuring labor productivity.

Implementation Strategy for Financial KPIs

Phase 1: Assessment and Selection

Start by identifying which financial KPI metrics align with your strategic objectives and stakeholder needs. Consider your industry, business model, growth stage, and key financial risks. Select 10-15 core KPIs that provide comprehensive financial health visibility without overwhelming users.

Audit your current financial systems and data quality. Ensure you can accurately calculate selected KPIs with available data. Identify gaps requiring system improvements or process changes.

Phase 2: Infrastructure and Processes

Establish clear calculation methodologies for each KPI. Document formulas, data sources, update frequencies, and responsible parties. Create a KPI dictionary ensuring consistent interpretation across the organization.

Implement or improve data collection and calculation processes. Automate wherever possible to reduce manual effort and errors. Build validation checks to catch data quality issues early.

Develop your financial KPI dashboard framework. Start simple—even basic Excel dashboards provide value if they’re used consistently and contain accurate data.

Phase 3: Adoption and Refinement

Roll out dashboards with appropriate training for users at each level. Ensure finance team members understand how to interpret KPIs and explain them to stakeholders.

Establish regular review cadences: weekly for operational metrics, monthly for comprehensive financial reviews, quarterly for strategic assessment. Make KPI review a standard part of management meetings.

Continuously refine your KPI selection and presentation based on user feedback and changing business needs. Remove KPIs that don’t drive decisions; add new ones as priorities evolve.

Common Financial KPI Pitfalls

- Tracking Too Many Metrics: Organizations often track dozens of financial metrics, creating information overload. Focus on the vital few that truly drive decisions. Start with 10-15 KPIs and resist the urge to add more without removing others.

- Ignoring Non-Financial Context: Financial KPIs tell you what happened, but not always why. Pair financial metrics with operational KPIs to understand root causes. Declining margins might result from pricing pressure, operational inefficiency, or changing product mix.

- Static Benchmarks: What constitutes “good” performance changes with market conditions, company lifecycle stage, and strategic priorities. Review targets and benchmarks quarterly to ensure continued relevance.

- Lack of Action: Collecting financial data without acting on insights wastes resources and undermines credibility. Establish clear protocols for responding when KPIs fall outside acceptable ranges.

- Gaming the System: When compensation ties too directly to specific KPIs, behavior can optimize for the metric rather than actual performance. Balance multiple KPIs to prevent unintended consequences.

Measuring Financial Performance Impact

Connect your financial KPI tracking to tangible business improvements:

Cost Reduction Identification: Regular monitoring of efficiency ratios and cost trends reveals opportunities for operational improvement. Companies that actively track and optimize working capital metrics typically reduce cash conversion cycles by 15-30%.

Capital Allocation Optimization: ROI and profitability metrics guide better investment decisions. Organizations using data-driven capital allocation achieve 20-30% higher returns on invested capital than those relying on intuition.

Risk Management: Liquidity and leverage ratios provide early warning of financial stress, enabling proactive intervention before crises develop. Companies with robust financial monitoring systems experience fewer financial surprises and maintain stronger stakeholder confidence.

Conclusion

Effective financial KPI implementation transforms financial management from reactive reporting to proactive performance optimization. By selecting the right metrics, building reliable measurement systems, and consistently acting on insights, finance teams demonstrate clear value while continuously improving financial health.

Success requires starting with focused metrics aligned with business objectives, ensuring data accuracy and consistency, and fostering a culture where financial KPIs drive decisions at all organizational levels. Whether you’re a financial analyst tracking forecast accuracy, a financial controller managing month-end close efficiency, or a CFO demonstrating value to investors, the right KPI framework makes financial performance transparent and actionable.

Remember that the most sophisticated financial KPI dashboard—whether built in Excel or enterprise software—is only valuable if it enables better decisions and drives improved outcomes. Focus on actionable insights, ensure stakeholders understand how to interpret and use the data, and maintain relentless focus on the metrics that truly matter for your business.

Ready to implement comprehensive KPI tracking across your entire organization? Learn about essential business metrics and measurement frameworks in our complete guide to Key Performance Indicators.